Moving to Portugal from the UAE: What you should know

Posted on: 11th August 2022 in

Expats

With a high quality of life and fantastic business opportunities, Portugal is a top destination for foreign nationals across the globe.

Still, moving to a foreign country is a huge step, and there is a lot to think about before you even board the plane.

In this article, we look at what expats from the United Arab Emirates need to know before moving to Portugal.

Living and working in Portugal

There are three main types of visa in Portugal:

- Short stay: otherwise known as a tourist or Schengen visa, they allow you to stay in the country for 90 days.

- Temporary stay visas: these are valid for up to one year.

- Long stay visas: also known as residency visas are for stays of over a year.

Non-EU citizens typically need a short-stay tourist visa to enter unless their country of residence has an agreement with Portugal.

The UAE does, meaning Emirati citizens do not need a Portugal tourist visa to enter the country for up to 90 days. These short-stay visas are great for those planning a visit to explore the job market or find somewhere to live.

However, those planning to move to Portugal for an extended period will need to look at other options. The Portugal Golden Visa is probably one of the most effective ways to become a resident.

Not only will the program grant residence permits for you and your family, but it also offers a path to Portuguese citizenship and a passport after five years. Residents also benefit from greater freedom of movement, especially within the Schengen Area.

The golden visa program also allows you to access a favourable tax regime which we will cover in the next section.

For more information on visas and how to apply online, the Portuguese Embassy in the UAE website.

Tax for UAE expats

Unlike in the UAE, your salary is subject to income tax.

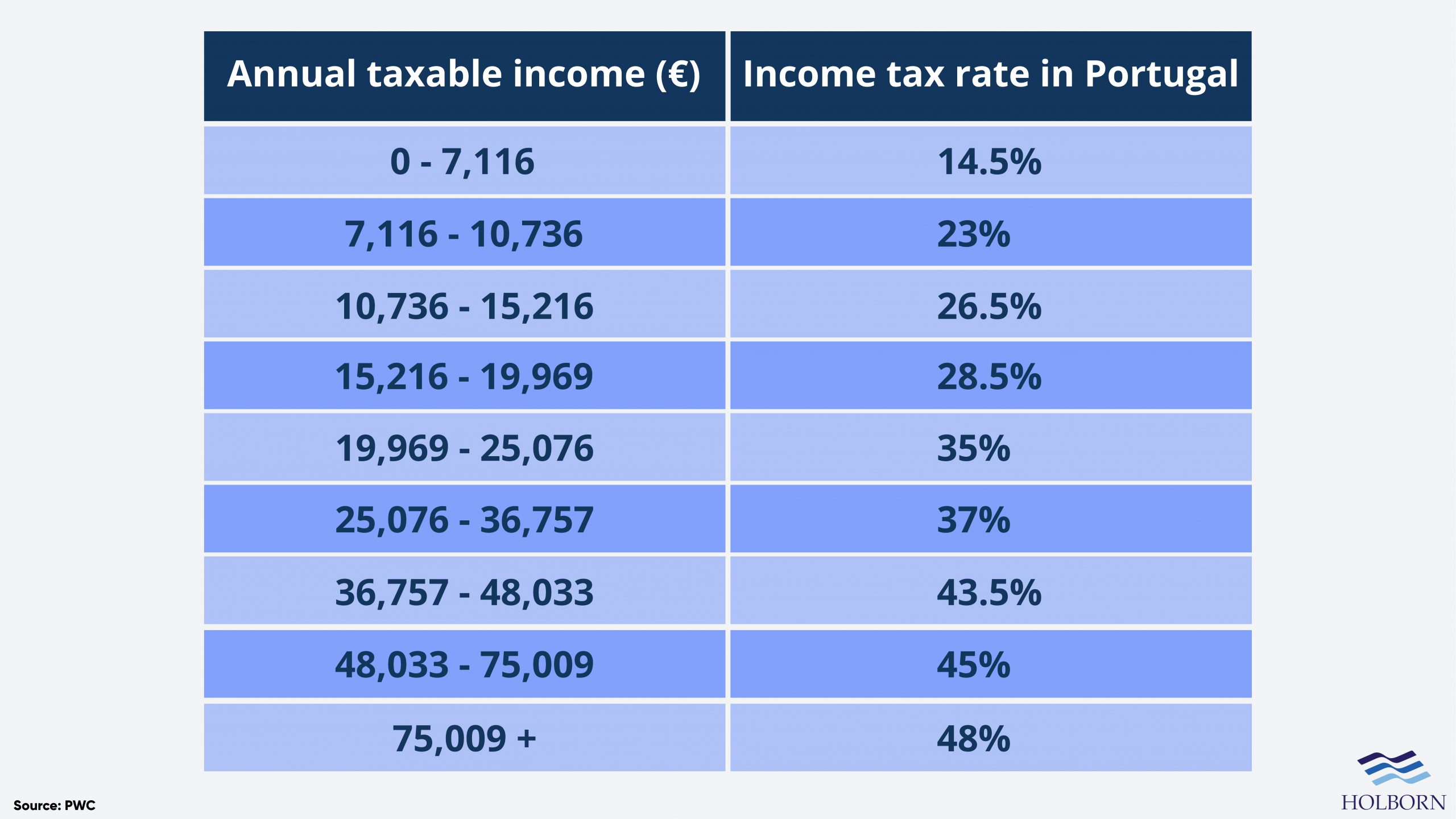

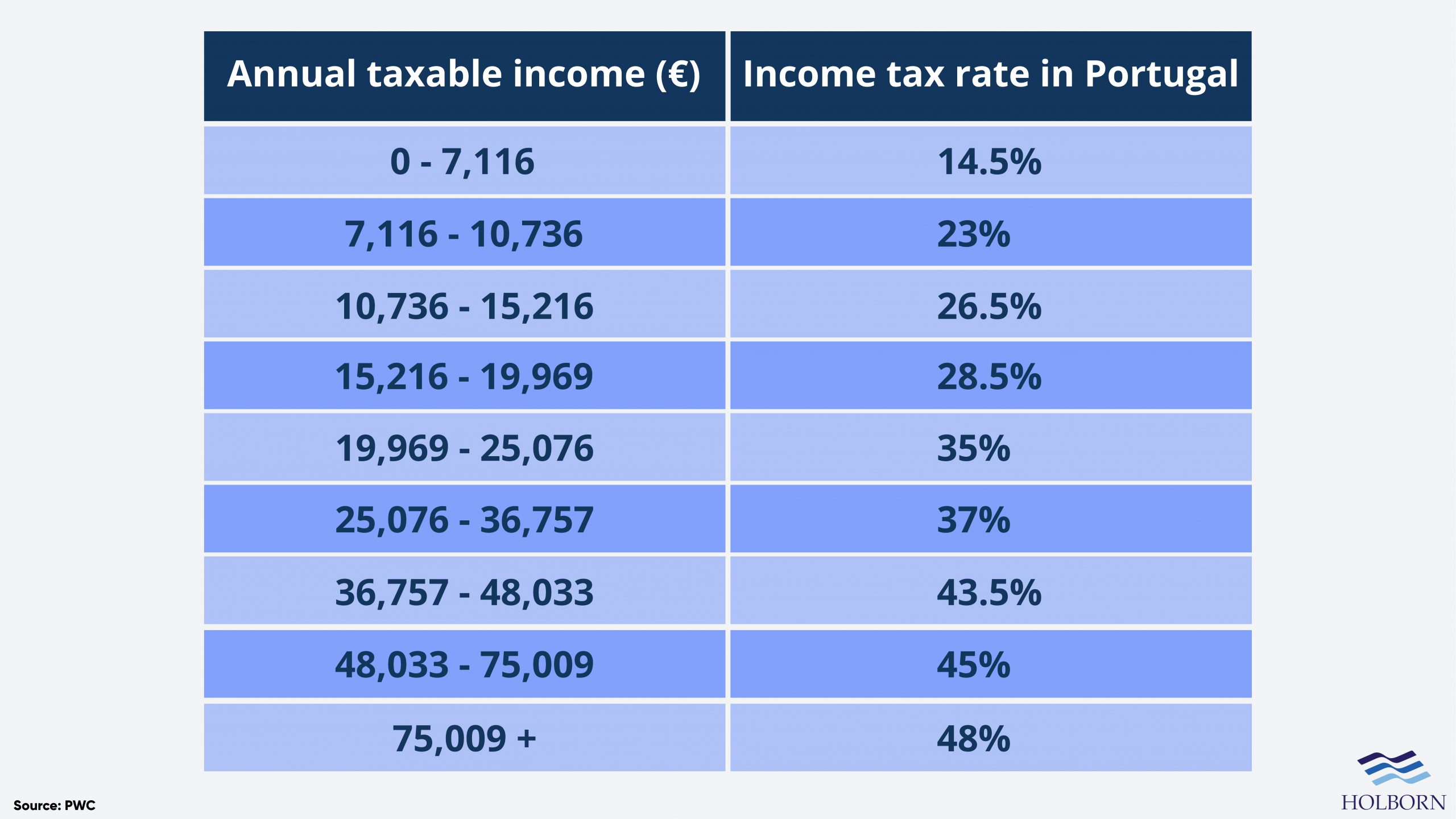

Tax in Portugal works on a scale, meaning the more you earn, the more income tax you pay. Income rates range from 14.5% up to 48%.

While these rates may come as a shock for UAE citizens moving to Portugal, some can take advantage of a special tax regime.

The Non-habitual Resident (NHR) program offers substantial savings and exemptions on tax for the first 10 years of Portuguese residency.

Those who qualify will pay a flat rate of 20% on all Portuguese earnings. Also, you will not pay tax in Portugal on some worldwide earnings, such as employment income and capital gains.

Your tax residency status and the tax implications surrounding foreign employment income are complex topics. If you are unsure, you should speak with a specialist who can advise you based on your situation.

Finding a place to live in Portugal

If you have bought a property as part of the Portugal Golden Visa, you may already have a place to live in the country. If not, finding a place to live will be a top priority.

You will also need suitable accommodation if you apply for a long-stay visa.

While you pay income tax in Portugal, the cost of living is much lower than in most parts of the UAE. Rental prices, in particular, are significantly lower than in Emeriti cities such as Dubai and Abu Dhabi, according to Numbero.

A large portion of the population in Lisbon are foreign nationals, making it a popular choice for expats and digital nomads. Rent prices in the capital are nearly 36% lower than in Abu Dhabi and just under 34% lower than in Dubai.

The rental cost for a 3-bedroom city centre apartment in Lisbon is around 7,317 AED (€1,950) per month. The equivalent in Dubai is roughly 10,638 AED (€2,835), making it just over 31% more expensive.

Healthcare in Portugal

Portugal has a state-funded healthcare system (Serviço Nacional de Saúde). As a resident, you have the same access to public healthcare as a Portuguese citizen.

Those from European countries can use the healthcare system. However, private health insurance is essential for non-EU nationals who are not residents.

Health insurance is relatively cheap and gives you access to a broader range of health services. Accessing services is also typically quicker, making it a viable option even if you can access the public healthcare system.

How Holborn Assets can help

Packing up your life in the UAE and moving to Portugal is a huge step. There is a lot to think about, including finances.

So, whether you are looking to retire in Portugal or move there for work, Holborn Assets can help.

For over 20 years, we have worked with expats across the globe, helping them achieve their financial goals and building a more secure future. We specialise in the expat market, so we understand the difficulties you face when moving abroad.

Still, with award-winning customer service and tailored, expert advice, you can be sure that you are in safe hands.

Are you moving to Portugal? Contact us using the form below to find out how we can help you.